The emergence of generative artificial intelligence chatbots like ChatGPT and Grok is introducing new disruptive possibilities for most professions, including crypto traders.

The unprecedented research and analytical capabilities of these generative AI models are emerging as new innovative tools for some of the world’s most key industries.

These include the fields of medicine, law, logistics, software development, and even cryptocurrency trading.

For new investors looking to profit from the soaring cryptocurrency valuations, ChatGPT is emerging as the golden ticket for generating quick returns through a phenomenon called copy-trading.

Copy-trading is a form of social trading enabling you to replicate the investments of the most profitable cryptocurrency traders automatically.

This CoinStats Premium article will teach you how to become a profitable copy-trader and emulate every strategic move of the industry’s best cryptocurrency traders by simply using ChatGPT prompts.

Step 1: Choosing the best cryptocurrency exchange for copy-trading

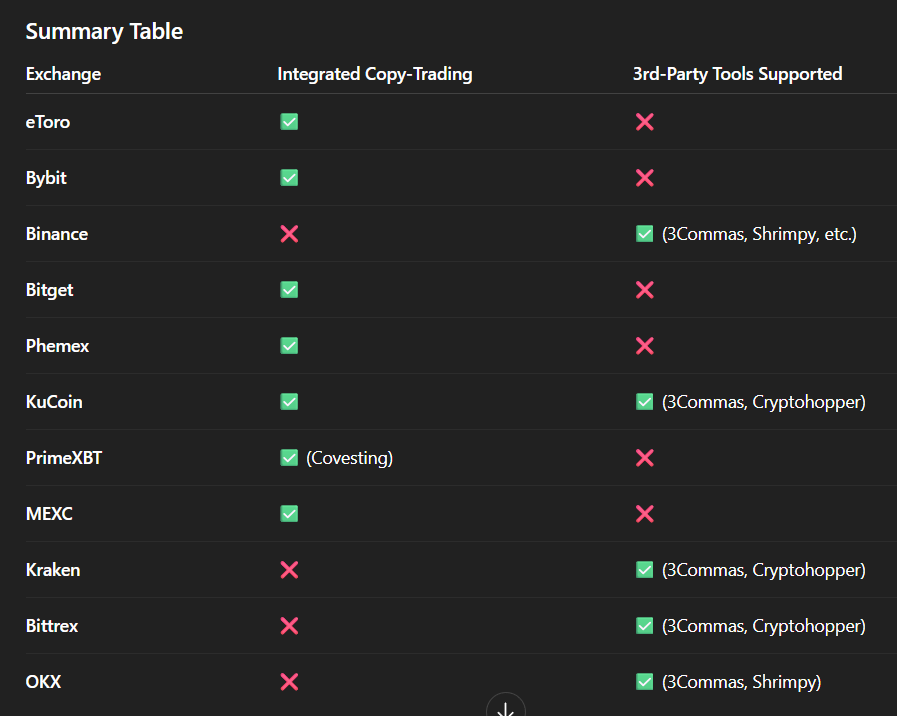

The first step is to choose the best cryptocurrency exchange for your copy-trading needs.

If you’re looking for the most established exchange to keep your assets safe, Binance is the world’s largest by trading volume. But users can only copy-trade on Binance via 3rd party API tools such as 3Commas copy-trading solution.

Other exchanges like Phemex and Bitget offer integrated copy-trading solutions that may be easier to use for beginners.

To simplify your search, log into ChatGPT and simply use the following prompt: “List the most user-friendly platforms for cryptocurrency copy-trading.”

To refine your search results, add details about your specific needs, such as your personal trading priorities, level of expertise, your geolocation for easier Know Your Customer (KYC) verification, or specific tokens and sectors you’re looking to copy-trade.

Source: ChatGPT

Step 2: Finding the best traders for copy-trading

The second step is finding the right traders to emulate for your portfolio and personal risk appetite.

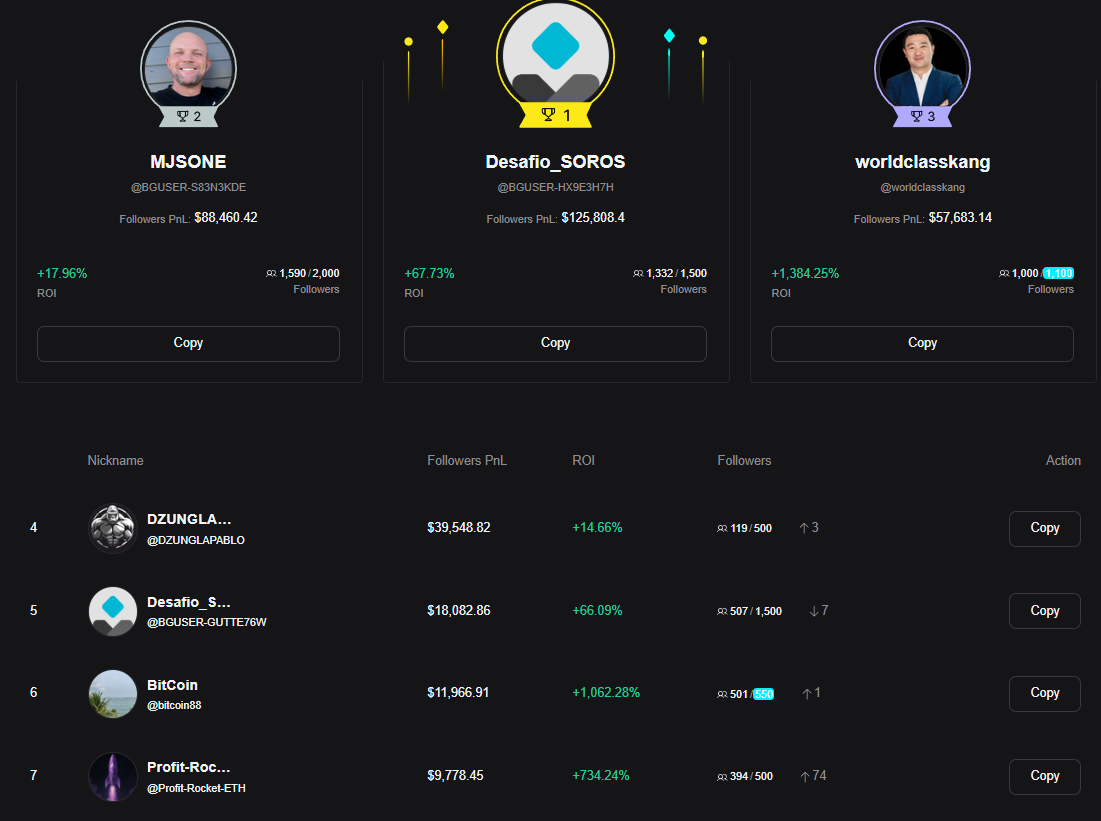

If you opted for an exchange with integrated copy-trading capabilities like Bybit, Bitget, Phemex, or KuCoin, using the platform’s trader leaderboard can help you intuitively see the best-performing accounts.

Make sure to look at metrics such as the profit and loss ratio (PnL), win rate, number of followers, and trading frequency to gauge if this is the right fit for you.

On Bitget, you can even filter the best copy-traders by the amount of profit they generated to their followers, as seen below.

Source: Bitget

Another option is looking at the top traders on the crypto platform Nansen, which offers multiple leaderboards on the accounts that boasted the biggest wins, even categorized per sectors and blockchains.

After finding a few promising traders, use ChatGPT to share ratings and additional insights on each trader’s performance.

Prompt the following: “Help me evaluate this trader’s performance on Bitget based on their last 30-day PnL and win rate. Rate his performance 1 to 10, compare it to other top traders.”

Step 3: Fund your account and start copy-trading

Before you can start copy-trading your way to generational wealth, you first need to fund your account, keeping in mind that the first bank transfer may take up to a few days to be sent and validated.

After your funds are in your account, visit your API or the platform’s copy-trading interface and select the traders you previously vetted for copy-trading.

Choose your trader and start setting the parameters, including investment amount, risk settings, and stop copy (stop loss) conditions.

If you’re unsure about how much you should invest, turn to ChatGPT for some analytic advice.

To find out about the right investment size for your needs, prompt ChatGPT by editing the following to your financial situation: “What is the right cryptocurrency investment size for a young adult with a salary of $100,000, living in Pennsylvania, with no co-dependents and no outstanding credit?”

Step 4: Market sentiment monitoring and portfolio optimization via ChatGPT

ChatGPT can help you track your copy-trading track record and the performance of the chosen traders regularly.

More importantly, ChatGPT can detect more subtle trading performance changes and provide an exit strategy before you take a bigger loss, along with the original trader.

But contextualizing the trader’s performance, even his losses, in relation to the wider crypto market is crucial to making a good decision.

This is where ChatGPT can help identify whether it’s the trader’s choices or a wider systemic crypto market catalyst behind the loss.

Prompt the following: “My copy trader had a 10% drawdown this week. Is he underperforming the crypto market? What could be the reason causing this in the current crypto market?”

You can ask for a more detailed analysis of his trading strategies by providing more information and links on the trader’s holdings and recent portfolio changes.

If he is underperforming the market significantly, it may be time to consider following other traders or refocusing strategies.

Setting up your daily crypto market update with ChatGPT

While copy-trading is a great way to start gaining exposure to digital assets, it’s crucial to start understanding the daily developments moving investor mindshare.

To cut down on hours of market sentiment research, use ChatGPT and copy-paste the following prompt:

“Give me a daily crypto market update, including:

Top-performing coins (based on 24h price change)

General market sentiment (bullish, bearish, neutral, and why)

Key news affecting the market (macro trends, regulatory updates, or significant events)

Major price moves and trends (Bitcoin, Ethereum, and top altcoins)

Technical analysis: Short-term trend indicators like RSI, MACD, or key support/resistance levels.

Any significant market alerts or upcoming events to watch (like hard forks, major partnerships, etc.)”

ChatGPT trade ideas: become a pro trader yourself with AI trade setups

Now that your copy-trading portfolio is set up and you have gained some understanding of cryptocurrencies, it’s time to dip your toes into the markets and become a trader yourself.

Start by using ChatGPT to learn about trading terminology or find out more about the implications of key technical chart patterns.

And the best part? ChatGPT can offer you real-time trade ideas for specific cryptocurrencies by using the following prompt:

Provide a trading setup for Bitcoin based on its current price action and indicators (RSI, MACD, moving averages). Should I be looking to go long or short? What are the key entry, stop loss, and take profit levels?”

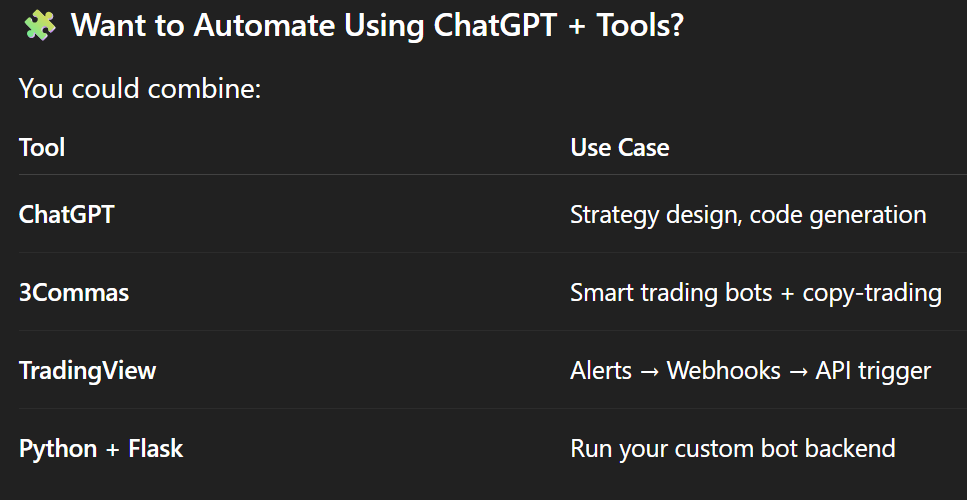

Building an automated crypto trading bot for the hardcore traders

For the hardcore traders out there, ChatGPT can help create your own trading bot from scratch, but this is not for beginners seeking user-friendly options.

Adjust to your own trading strategies and prompt the following: “Write a Python script to automatically buy ETH/USDT when the price drops 5% within 30 minutes on Binance Futures.”

Source: ChatGPT

Or include more advanced momentum indicators, like the following prompt: “Create a Python crypto trading bot that buys BTC when RSI < 30 and sells when RSI > 70 using Binance API.”

Pro tips directly from ChatGPT to CoinStats Premium investors

When asked for some key advice for CoinStats Premium’s investors, ChatGPT shared the following:

- Don’t just chase returns – look at consistency and risk.

- Use demo accounts first if available.

- Diversify: Copy multiple traders with different styles.

- Understand the strategies they’re using (ChatGPT can help break them down).

ChatGPT is not perfect: always double-check trade setups, analysis

While generative AI chatbots like ChatGPT may soar to become the most disruptive technology of our generation, they are still far from perfect.

Issues, including AI hallucinations, misunderstanding context, and generating inaccurate results, continue to plague the chatbot’s reliability when it comes to critical use cases.

This is why it’s crucial to do your own research (DYOR) and thoroughly double-check ChatGPT’s analysis when it comes to traders or investment advice.

Don’t lose your savings on an AI hallucination. DYOR.

0 Comments