The cryptocurrency market has experienced rapid growth, attracting a diverse range of traders and investors. In this dynamic landscape, Artificial Intelligence (AI) trading bots have gained significant popularity.

An AI crypto trading bot uses Artificial Intelligence algorithms to analyze market data, employ specific trading strategies, and execute trades based on market conditions on behalf of the user. Cryptocurrency trading bots offer myriad benefits for crypto trading, enhancing the trading efficiency and profitability of crypto traders and empowering them to navigate the market with precision and confidence.

This article explores the advantages of using AI trading bots for profitable trades and reviews the five best AI crypto trading bots for July 2023.

Let's get right to it!

What Are AI Crypto Trading Bots?

AI-powered crypto bots can monitor and execute trades across multiple crypto exchanges, enabling crypto investors and professional traders to diversify their portfolios, maximize profits, and manage risks.

These automated trading bots utilize the power of Artificial Intelligence and advanced trading algorithms to automate trading processes, making them more efficient and profitable. By continuously learning from new data and adapting their strategies, these bots can uncover hidden patterns and execute trades with precision.

AI crypto trading bots analyze and interpret vast market data, including real-time price and volume information, and scan several digital currency markets. They identify trends, patterns, and trading signals, providing traders access to a wide range of information to help them make trading decisions.

The ability of AI crypto trading bots to process and analyze large amounts of data in real-time gives them a significant advantage over manual trading. AI-powered trading bots can quickly spot emerging opportunities or potential risks, enabling traders to capitalize on favorable market conditions and mitigate potential losses. Bot trading automates the trading process and eliminates the emotional biases and human errors that often impact decision-making.

The Best AI Crypto Trading Bots

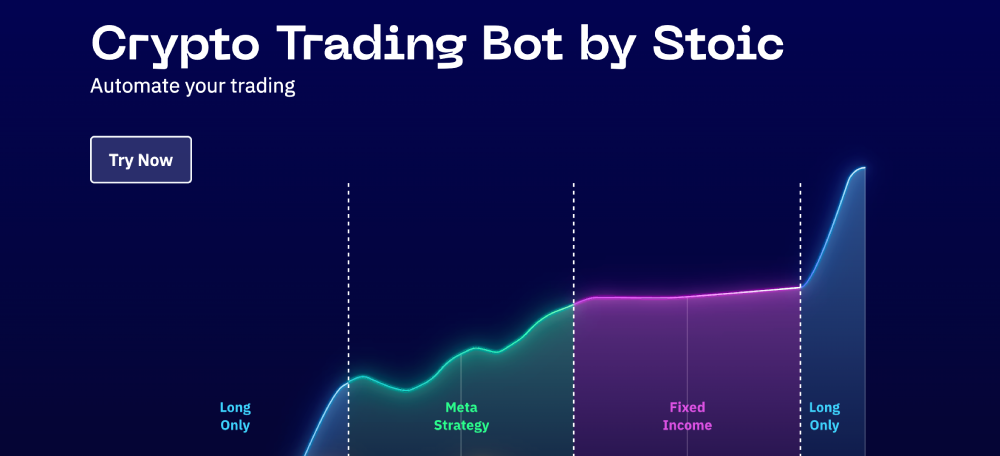

1. Stoic.AI

- Utilizes AI and machine learning algorithms to analyze market data and make data-driven trading decisions

- Offers a user-friendly interface with easy setup and configuration

- Provides a range of trading strategies and customizable options

- Offers backtesting capabilities to assess the performance of trading strategies

Advantages

- Designed for both beginner traders and experienced traders

- Offers diversified portfolio management

- Provides seamless integration with multiple exchanges

- Notable Achievements: Stoic.AI has consistently delivered competitive returns and demonstrated robust performance in various market conditions.

Pricing: Stoic.AI offers a subscription-based pricing model with different plans based on the user's trading capital. The pricing details can be found on their official website.

Compatibility with Portfolio Tracking Service: Stoic.AI integrates with various portfolio tracking services, allowing users to sync their crypto holdings and monitor their portfolio performance effectively.

2. BotCrypto

- Utilizes AI and deep learning algorithms for market analysis and trade execution

- Offers a user-friendly interface with customizable trading strategies

- Provides real-time alerts and notifications for trading opportunities

- Supports multiple cryptocurrency exchanges for seamless trading

Advantages

- Offers advanced a wide range of trading tools, including stop-loss and take-profit orders

- Provides detailed performance reports and analytics

- Offers backtesting capabilities for strategy evaluation

- BotCrypto has gained recognition for its accurate market analysis and consistent profitability in various market conditions.

Pricing: BotCrypto offers different pricing plans with varying features and trading limits.

3. Shrimpy

- Utilizes AI and machine learning to optimize portfolio allocations and rebalancing

- Offers a unified dashboard for managing multiple cryptocurrency exchanges and wallets

- Social trading features, allowing users to follow and replicate successful traders

- Supports both manual and automated trading strategies

Advantages

- Offers portfolio automation and rebalancing for risk management

- Provides a range of customizable portfolio management strategies

- Supports a wide range of cryptocurrencies and exchanges

- Notable Achievements: Shrimpy has received positive reviews for its user-friendly interface, portfolio management features, and successful social trading functionality.

Pricing: Shrimpy offers different pricing plans with varying features and trading limits. The pricing details can be found on their official website.

4. CryptoHopper

- Utilizes AI and machine learning algorithms for market analysis and trade execution

- Offers a user-friendly interface with customizable trading strategies and indicators

- Provides backtesting capabilities to evaluate trading strategies

- Supports automated trading on multiple cryptocurrency exchanges

Advantages

- Offers a wide range of technical indicators and signalers for advanced trading strategies, including copy trading and trading with AI crypto bots

- Provides extensive community support and social trading features

- Offers a mobile app for convenient trading on the go

- CryptoHopper has gained popularity for its extensive range of features, user-friendly interface, and successful trading performance.

5. Kryll

- Utilizes AI and machine learning algorithms for strategy creation and trade execution

- Offers a visual strategy editor for creating customized trading strategies

- Provides backtesting and simulation capabilities for strategy evaluation

- Supports multiple cryptocurrency exchanges for automated trading

Advantages

- Offers a thriving community marketplace for sharing and purchasing trading strategies

- Provides real-time performance monitoring and detailed analytics

- Offers mobile apps for trading on the go

- Kryll has gained recognition for its user-friendly interface, extensive strategy marketplace, and successful trading results.

Overview of AI Trading Bots

AI crypto trading bots, also known as automated trading systems, are computer programs that utilize Artificial Intelligence and machine learning algorithms to execute trades in the cryptocurrency market. These bots are designed to analyze vast market data and identify patterns to help crypto investors make informed trading decisions.

AI trading bots can track various indicators, such as price movements, volume, and market sentiment, to identify potential trading opportunities or signals. By continuously monitoring the market, these bots aim to capitalize on favorable conditions and execute trades with speed and precision.

The working mechanism of AI trading bots can be summarized in the following steps:

Data Gathering: AI trading bots collect vast amounts of data from various sources, including cryptocurrency exchanges, financial news platforms, social media, and other relevant sources. This data includes price feeds, historical market data, news articles, and social sentiment.

Data Analysis: Once the data is collected, AI trading bots utilize advanced algorithms and machine learning models to analyze and interpret the information. They identify patterns, trends, and anomalies indicating potential trading opportunities or risks.

Strategy Formulation: The AI trading bot formulates a trading strategy based on predefined rules and strategies set by the user or through machine learning models learned from historical data. This strategy can include parameters such as entry and exit points, stop-loss levels, take-profit targets, and risk management rules.

Execution: When the predefined conditions are met, the AI trading bot automatically executes trades on behalf of the user. It sends buy or sell orders to the connected cryptocurrency exchange, considering the specified parameters and the current market conditions.

Monitoring and Adjustment: AI trading bots continuously monitor executed trades and market conditions. Based on changing market dynamics, they can adjust trading strategies in real-time, ensuring that the bot adapts to new trends and market movements.

Benefits of Using AI Trading Bots for Crypto Trading

Using an AI trading bot can help both seasoned traders and novices automate crypto trading and efficiently manage their portfolios. AI trading bots learn from new data and adjust their trading strategies accordingly, unlike regular trading bots limited to the rules set by human traders.

Here are some of the benefits of crypto trading using a crypto bot.

Enhanced Decision-Making: AI trading bots utilize advanced algorithms and machine learning techniques to analyze vast amounts of real-time data. These bots make data-driven decisions by processing market trends, historical patterns, and indicators, reducing the impact of human emotions and biases. This empowers traders to execute precise and timely trades, maximizing profit potential.

Increased Efficiency: The crypto market operates 24/7, and monitoring it constantly can be challenging for human traders. AI trading bots excel in round-the-clock monitoring and can instantly react to market movements, execute trades, and manage portfolios. This eliminates the need for manual oversight, allowing traders to capitalize on profitable opportunities even while they sleep.

Rapid Execution: Speed is crucial in the fast-paced crypto market, where prices can change within seconds. AI trading bots can execute trades with exceptional speed, ensuring minimal lag time between market movements and order placement. This advantage is especially critical in volatile market conditions, where split-second decisions can make a significant difference.

Risk Management: AI trading bots are equipped with sophisticated risk management features. They can automatically set stop-loss orders, trailing stops, and other risk mitigation measures to protect trading capital. Additionally, these bots can analyze market conditions and adjust trading strategies accordingly, optimizing risk-reward ratios.

Diversification and Portfolio Tracking: Some AI trading bots offer portfolio tracking functionalities, allowing users to manage multiple cryptocurrencies and exchanges from a single platform. These bots can provide real-time insights into portfolio performance, asset allocation, and historical data analysis. Such comprehensive monitoring capabilities enable traders to make informed decisions and diversify their crypto holdings effectively.

Conclusion

In the dynamic world of cryptocurrency trading, staying ahead of the game is crucial to maximizing profits and minimizing risks. With the advent of Artificial Intelligence (AI) technology, crypto traders now have a powerful tool at their disposal – AI crypto trading bots leveraging advanced algorithms and machine learning to analyze vast amounts of data, execute trades, and optimize trading strategies.

Using one of the best trading bots in the market, you'll gain a competitive edge by quickly responding to market changes and exploiting profitable opportunities.

Disclaimer: All information provided in or through the CoinStats Website is for informational and educational purposes only. It does not constitute a recommendation to enter into a particular transaction or investment strategy and should not be relied upon in making an investment decision. Any investment decision made by you is entirely at your own risk. In no event shall CoinStats be liable for any incurred losses. See our Disclaimer and Editorial Guidelines to learn more.

0 Comments